- The Multicapital Approach

- A Multicapital Approach and Integrated Reporting

- From Monocapitalism to A Multicapital Approach

- A Multicapital Approach: Development and Frameworks

- Forum’s Five Capital Model

- NCRCRD’s Seven Community Capitals

- Adoption and Impact

- Moving Forward

- A Thrivable Framework

- References

Multicapitalism is a concept becoming adopted by increasing numbers of businesses and organisations as a response to the shortcomings of traditional capitalism. While traditional capitalism primarily focuses on financial capital, the multicapital approach considers multiple forms of capital, including natural, social, human, and manufactured capital. This article provides an overview of the history and development of multicapitalism and some examples of the different ways in which a multicapital approach can be used today across different sectors.

the multicapital Approach

The Rise of Corporate Social Responsibility

Climate change, biodiversity loss, pollution, and resource depletion define the current state of our environment. As a result, businesses are urged to be more transparent through Corporate Sustainability Accounting. Many have adopted a management concept widely known as Corporate Social Responsibility (CSR). In other words, it refers to incorporating social and environmental considerations into a firm’s business operations. The term was first coined in 1953 by American economist Howard Bowen in his book “Social Duties of the Businessman,” where he emphasised the enormous influence of business activities on society. He therefore concluded that companies have a moral duty to adopt strategies for the common good.[1] Broadly speaking, CSR refers to a company’s commitment to its economic, environmental, and social goals, whilst simultaneously meeting stakeholder and shareholder expectations.

One way to measure these efforts is by using an accounting framework called the Triple Bottom Line (TBL) approach. This term was first introduced in 1994 by John Elkington, founder of SustainAbility.[2] The three P’s are profit, people, and the planet. The first bottom line, “profit,” is the traditional measure of corporate performance that focuses on financial accounting. The second and third bottom lines refer to accounting for social responsibility (“people”) and environmental responsibility (“planet”). In principle, the triple bottom line does not necessarily prioritise people and planet over profits, but many companies have reaped financial benefits from the TBL approach.[3]

A Multicapital Approach and Integrated Reporting

There is growing support for the adoption of an integrated reporting framework for the performance assessment of organisations. It aims to integrate risk management, strategy, and sustainability into financial reporting.[4] A critical element of sustainable reporting is the use of a multiple capital model (MCM), or multicapital approach. In summary, MCM defines, measures, and quantifies multiple classes of capital. Altogether, this model provides organisations with better information for decision-making and provides transparency to stakeholders about the impact of their activities.

From Monocapitalism to A Multicapital Approach

In 2014, Thomas and McElroy introduced a concept called multicaptialism as a new economic doctrine to assess companies’ impacts in terms of multiple forms of capital. They argued that value is not limited to financial assets. Therefore, organisational performance should be measured in terms of its impact on vital capitals relative to sustainable standards.[5] The methodology is discussed in detail in their book “The MultiCapital Scorecard,” which was published in 2016.

Capital is broadly defined as “a stock of anything that yields a flow of valuable goods or services important for human well-being.”[6]

In the paper entitled “From Monocapitalism to Multicapitalism: 21st Century System Value Creation” by Bill Baue published by r3.0 (2020), monocapitalism and multicapitalism are defined as follows [7]:

Monocapitalism: capitalism designed to grow and concentrate one form of vital capital – financial capital – very often at the expense of the ongoing viability of other capitals;

Multicapitalism: capitalism designed to maintain the carrying capacities of all vital capitals (natural, human, social, intellectual, constructed, and financial) respecting normative thresholds.

A Multicapital Approach: Development and Frameworks

The Multicapital Scorecard

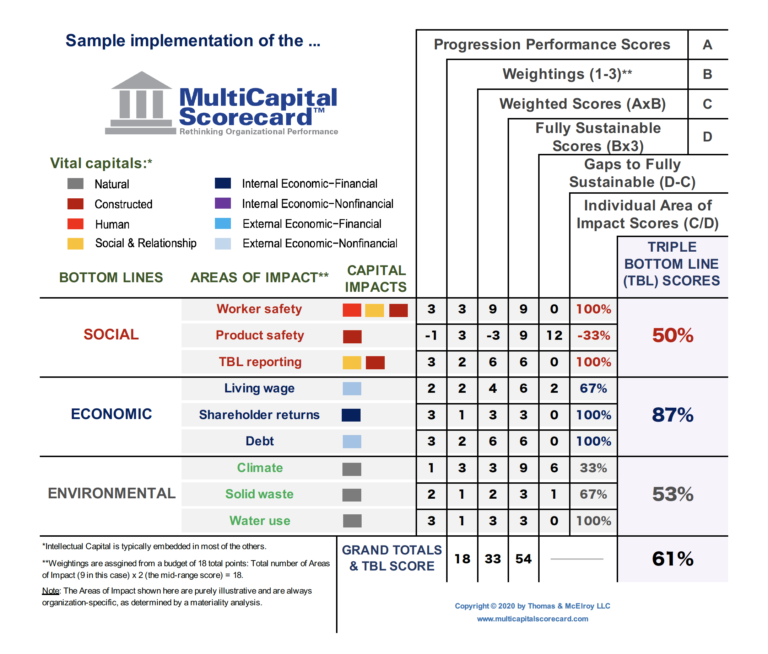

Thomas and McElroy developed the MultiCapital Scorecard (MCS) as a TBL performance measurement methodology for “a one-page report on the progression of the organisation towards meeting its sustainability norms.”[8] It expands the methodology called “Context-Based Sustainability” (CBS) that measures the social and environmental performance of organisations and includes the financial performance, creating an integrated measurement and management of the Triple Bottom Line.[5] Both MultiCapitalism and CBS perform assessments based on thresholds or sustainable norms. When defining sustainability norms, there is a distinction between capital thresholds, which refer to the carrying capacity of a vital capital, and allocations, which are the fair share of such thresholds. Moreover, it is important to note that the MultiCapital Scorecard is stakeholder-centric.[6]

The Vital Capitals

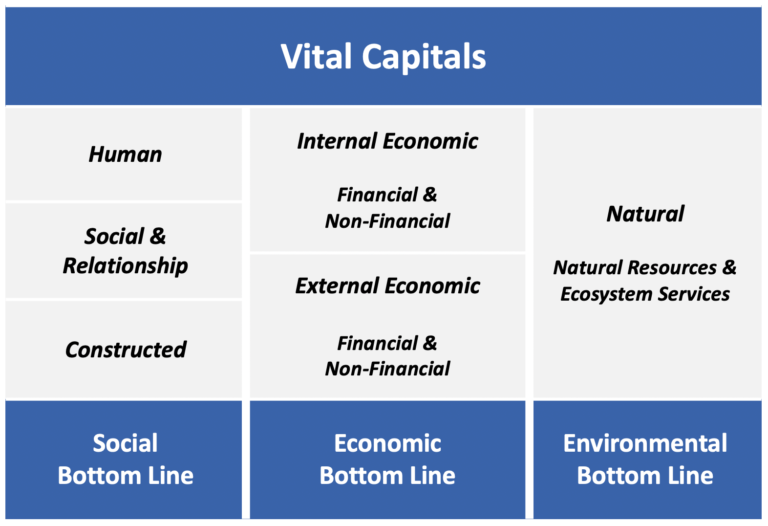

The five basic types of vital capital in The MultiCapital Scorecard are natural, human, social and relationship, constructed, and economic.[6] Capital theory in sustainability and economics defines six categories of capital, which include all five plus intellectual capital. In this MultiCapital Scorecard framework, intellectual capital is considered embedded in the other five.[6]

Multicapital Scorecard

To illustrate, the figure above shows the relationship between these vital capitals and the triple bottom line. The definitions of the capitals measured in this approach are summarised as follows:

- Natural capital: the natural resources and other natural biophysical resources that contribute to our well-being

- Human capital: the knowledge, skills, experience, health, and other values and entitlements created or contributed by humans

- Social and relationship capital: refers to teams or groups of individuals with shared knowledge, experience, health, and other values and entitlement

- Constructed capital: any material object, system, or ecosystem built by humans

- Internal economic capital

- Financial internal economic capital – the funds available within the organisation, including debt and equity, with more emphasis on the funding sources

- Nonfinancial internal economic capital – other assets not recognised in financial statements

- External economic capital

- Financial external economic capital – all funds available to entities external to the organisation

- Nonfinancial external economic capital – external capital that is nonfinancial and has economic value external to the organisation

The Multiple Capital Scorecard Methodology

The MCS methodology has three steps.

First is scoping and materiality. Organisations must identify what areas of impact (AOI) are relevant to their duties or obligations to stakeholders and apply materiality.

Then, firms should study each AOI and define the sustainability norms, trajectory targets, and data collection processes.

Finally, the third step is the scorecard implementation, where scores are tabulated for each AOI and grouped into their respective bottom lines. Altogether, these are integrated and scored for each TBL and for the organisation as a whole.[6]

Multicapital Scorecard

IIRC’s Integrated Reporting (IR) Framework

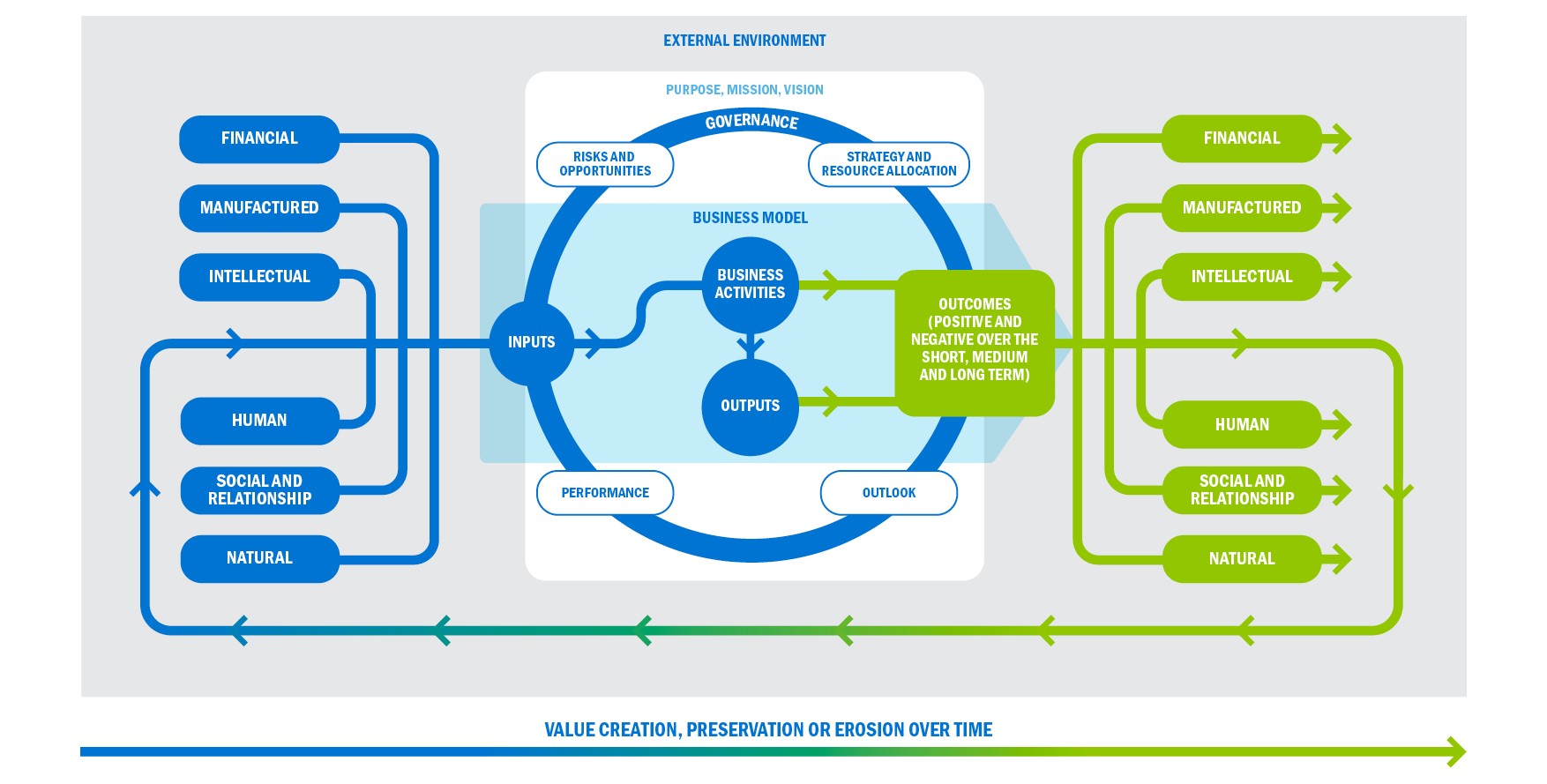

The International Integrated Reporting Council (IIRC) developed the Integrated Reporting (IR) Framework that emphasises Integrated Thinking, value creation over the short, medium, and long term, and accountability across multiple capitals in corporate reporting.[9] Primarily, Integrated Thinking refers to actively considering the relationships between units, functions, and capitals of the organisation.

Similarly, the IR framework refers to “capitals” as the resources and relationships used by the organisation. Activities may increase, decrease, or transform one or a mix of capitals. Specifically, the six capitals are:

- Financial capital – the pool of funds available for use (includes external financing)

- Manufactured capital – manufactured physical objects

- Intellectual capital – organisational knowledge

- Human capital – capabilities, competencies, experiences

- Social and relationship capital – institutions and relationships with communities and stakeholders

- Natural capital – environmental resources

Integrated Reporting

These capitals in the IR framework serve as the fundamental concepts underpinning the value creation, preservation, or erosion of an organisation. Additionally, the framework guides organisations to ensure that they take into consideration all used or affected capitals.

Forum’s Five Capital Model

Additionally, Forum for the Future employs a multicapital model, as outlined in their framework, to evaluate sustainability, which consists of five distinct capitals.[10] This perspective, rooted in Jonathon Porritt’s book “Capitalism As If The World Matters,” passionately advocates for a multicapital approach, emphasising the imperative for organisations to nurture and augment these capitals instead of depleting them. These five pivotal capitals are natural capital, social capital, human capital, financial capital, and manufactured capital. Consequently, this comprehensive model for sustainable development takes into account the interconnected impact of an organisation’s activities on each capital, fostering a holistic approach.

Forum for the Future

NCRCRD’s Seven Community Capitals

In 2014, Flora and Flora developed the Community Capitals Framework to understand how communities become healthy and sustainable. It identifies seven capitals for economic development (CED): natural, cultural, human, social, political, financial, and built capital. The North Central Regional Center for Rural Development (NCRCRD) with the National Rural Funders’ Collaborative uses these seven community capitals. [11]

The framework determines what partnerships they need and what activities must be done to succeed. Specifically, it helps project owners understand the strategic nature of the funded programs and their effects on reducing poverty and enhancing wealth, family self-sufficiency, and local leadership.

Adoption and Impact

One of the key messages from the International Federation of Accountants (IFAC) in the 2019 G20 conference in Osaka was to “embrace multicapitalism and integrated reporting in all G20 countries.” [12]

In a study done by the IFRS Foundation (2022), the adoption of integrated reporting was shown to be gaining momentum globally.[13] To illustrate, more than 2,500 organisations in more than 70 countries used the IR Framework. In addition, adopters encompass a broad spectrum of organisations, with public companies, small and medium enterprises, and non-profits all embracing it. Reports were produced in 71 out of the 77 industries based on the Sustainable Industry Classification System®. The leading sectors are from the Infrastructure, Financials, and Resource Transformation sectors.

Prior to this, Trucco et al (2021), argued that integrated thinking could support the implementation of United Nation’s Sustainable Development Goals (SDG) to operationalise SDG 17 (Partnerships for the Goals) and harmonise the rest of the SDGs (1 to 16). [14]

Furthermore, a study in 2022 by Sun et al. examined the impact of the new method of corporate reporting using a multiple capital disclosure (MCD) framework. They found a positive relationship between MCD quality and firm value.[15] Overall, they found that the framework had a positive impact on profitability by supporting both stakeholders and investors in decision-making.

moving forward

The idea of a multicapital approach shows a significant shift in the way businesses and organisations analyse impact and value creation. By considering multiple forms of capital, we can expand and measure organisations’ impact on society and the environment. Therefore, the adoption of the multicapital approach can help businesses go beyond traditional financial reporting and become more accountable and transparent to stakeholders and shareholders. Ultimately, this can help drive more sustainable and responsible practices across these sectors.

A Thrivable Framework

THRIVE Project invests interest in sustainability, including examining sustainable business practices, and promoting a holistic approach, using the systemic holistic model, that ensures environmental preservation and human well-being.

To learn more about how The THRIVE Project is researching, educating, and advocating for a future beyond sustainability, visit our website. You can follow our informative blog and podcast series and learn about our regular live webinars featuring expert guests in the field. Sign up for our newsletter for regular updates.

references

[1] Latapí Agudelo, M.A., Jóhannsdóttir, L. & Davídsdóttir, B. A literature review of the history and evolution of corporate social responsibility. Int J Corporate Soc Responsibility 4, 1 (2019). https://doi.org/10.1186/s40991-018-0039-y

[2] The Economist. (2009). Triple bottom line. The Economist. https://www.economist.com/news/2009/11/17/triple-bottom-line

[3] Miller, Kelsey. (2020). The Triple Bottom Line: What it is & Why it’s Important. Harvard Business School Online. https://online.hbs.edu/blog/post/what-is-the-triple-bottom-line

[4] Smith, Sean Stein (2015). Arguing for a Multiple Capital Model. International Journal of Managerial Studies and Research (IJMSR) Volume 3, Issue 5, May 2015, PP 22-32 https://www.arcjournals.org/pdfs/ijmsr/v3-i5/3.pdf

[5] Multicapitalism – A new economic doctrine for sustainability in commerce (n.d). MultiCapital Scorecard. https://multicapitalscorecard.com/multicapitalism-a-new-economic-doctrine-for-sustainability-in-commerce/

[6] Thomas, B., & McElroy, M. W. (2016). The MultiCapital Scorecard. Chelsea Green Publishing. https://www.cbcsd.cz/wp-content/uploads/2017/09/Thomas-and-Mc-Elroy-The-MultiCapital-Scorecard.pdf

[7] Baue, Bill (2020). From Monocapitalism to Multicapitalism: 21st Century System Value Creation. R3.0. https://www.r3-0.org/wp-content/uploads/2020/12/r3-0-White-Paper-1-2020-From-Monocapitalism-to-Multicapitalism.pdf

[8] Thomas, B., & McElroy, M. W. (2016). Does sustainable performance mean abandoning capitalism? The World Financial Review. https://worldfinancialreview.com/does-sustainable-performance-mean-abandoning-capitalism/

[9] International <IR> Framework. (2021). IFRS Foundation. https://www.integratedreporting.org/wp-content/uploads/2021/01/InternationalIntegratedReportingFramework.pdf

[10] The Five Capitals – a framework for sustainability. (2020). Forum for the Future. https://www.forumforthefuture.org/the-five-capitals

[11] Flora, C.B. et al (2006). Community capitals: A Tool for Evaluating Strategic Interventions and Projects. North Central Regional Center for Rural Development, Iowa State University. https://www.ksre.k-state.edu/community/civic-engagement/youth-community-perceptions/documents/Community-Capitals.pdf

[12] Leka, Laura. (2019). How is Integrated Reporting Adoption Progressing? International Federation of Accountants. https://www.ifac.org/knowledge-gateway/preparing-future-ready-professionals/discussion/how-integrated-reporting-adoption-progressing

[13] The growing momentum for integrated reporting: Part 1. (2022). IFRS Foundation. https://www.integratedreporting.org/news/the-growing-momentum-for-integrated-reporting-part-1/

[14] Trucco, S., Demartini, M.C. & Beretta, V. The reporting of sustainable development goals: is the integrated approach the missing link?. SN Bus Econ 1, 35 (2021). https://doi.org/10.1007/s43546-021-00046-9

[15] Sun Y, Qiao X, An Y, Fang Q, Wu N. Does Multiple Capitals Disclosure Affect the Capital Market? An Empirical Analysis in an Integrated Reporting Perspective. Front Psychol. 2022 Feb 24;13:837209. doi: 10.3389/fpsyg.2022.837209